Could refinancing your mortgage be the key to unlocking significant savings and a more secure financial future? The answer is a resounding YES, and understanding the landscape of Chase mortgage rates for refinancing is your crucial first step.

In the ever-evolving world of homeownership, the opportunity to refinance your mortgage presents itself as a potential game-changer. Whether your goals encompass lowering your monthly payments, shortening the duration of your loan, or tapping into the equity that has accumulated in your home, a thorough understanding of the available options is paramount. As one of the largest financial institutions in the United States, Chase offers a diverse array of mortgage refinancing solutions designed to accommodate the unique needs of homeowners. However, navigating the complexities of refinancing, particularly in understanding the nuances of interest rates, associated fees, and the stringent eligibility requirements, can seem daunting. This in-depth analysis aims to demystify the process, equipping you with the knowledge necessary to make the most informed financial decisions. This article aims to provide actionable insights into Chase mortgage rates, the benefits associated with refinancing, and the best strategies to maximize your savings. Let's explore the opportunities that refinancing with Chase can unlock for you.

Table of Contents

- Understanding Mortgage Refinancing

- Chase Mortgage Rates for Refinancing

- Eligibility Requirements for Refinancing

- Benefits of Refinancing with Chase

- The Refinancing Process

- Costs Associated with Refinancing

- Current Market Trends in Mortgage Rates

- Comparison with Other Banks

- Tips for a Successful Refinancing Experience

- Frequently Asked Questions

Understanding Mortgage Refinancing

At its core, mortgage refinancing involves replacing your existing home loan with a new one, often under more advantageous terms. Homeowners commonly opt to refinance to secure a lower interest rate, thereby reducing their monthly payments, or to shorten the overall term of the loan. A solid grasp of the fundamentals of refinancing is essential before delving into the specifics of Chase mortgage rates.

- Jane Omeara Driscoll Behind Bernie Sanders A Look At His Spouse

- Unveiling Erome Megan Foc What Is It Why You Need To Know

Why Refinancing Makes Sense

Refinancing a mortgage can unlock a multitude of financial benefits, including:

- Lowering your monthly mortgage payments

- Transitioning from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage

- Tapping into your home's equity for other financial needs

Each of these advantages can contribute to a more stable financial future, making refinancing an appealing option for many homeowners.

Chase Mortgage Rates for Refinancing

Chase provides competitive mortgage rates for refinancing that can help you save money over the entire lifespan of your loan. These rates are not static; they fluctuate based on a variety of factors, including your credit score, the loan-to-value ratio (LTV) of your property, and the type of mortgage you ultimately choose.

- Gig Harbor Wa Eats Your Guide To Delicious Dining

- Masafun Your Travel Hub Find Adventures Amp Connect

Factors Influencing Chase Mortgage Rates

Several key factors significantly impact the mortgage rates offered by Chase for refinancing:

- Credit Score: A higher credit score generally leads to lower interest rates. A strong credit profile signals a lower risk for the lender.

- Loan-to-Value Ratio (LTV): A lower LTV (the ratio of the loan amount to the property's value) can result in more favorable rates. This indicates that you have more equity in your home.

- Loan Type: Fixed-rate mortgages and adjustable-rate mortgages (ARMs) have inherently different rate structures. Fixed-rate mortgages offer predictability, while ARMs may start with lower rates that can change over time.

Careful assessment of these factors is crucial for identifying the most suitable refinancing option for your particular circumstances. Understanding how these factors influence the rates you qualify for empowers you to make a smart decision.

Eligibility Requirements for Refinancing

Before you even consider applying for refinancing with Chase, it's essential to thoroughly understand the eligibility requirements. While the mortgage rates offered by Chase for refinancing are competitive, you must meet certain criteria to qualify:

- A stable and verifiable income source

- A minimum credit score, typically 620 or higher, although this can vary

- A sufficient amount of equity in your home, usually at least 20% of the property's current market value

Successfully meeting these requirements significantly increases your chances of securing a favorable refinancing agreement with Chase, setting the stage for potential savings and improved financial flexibility.

Benefits of Refinancing with Chase

Refinancing with Chase offers several compelling advantages, making it an attractive option for homeowners seeking to improve their financial position:

Lower Monthly Payments

By securing a lower interest rate, you can dramatically reduce your monthly mortgage payments. This freed-up capital can be reallocated to other essential financial goals, such as bolstering your savings, paying down other debts, or investing for the future.

Improved Loan Terms

Chase provides the flexibility to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. This transition offers unparalleled stability and predictability in your monthly payments, allowing you to budget with greater confidence and avoid the volatility associated with fluctuating interest rates.

Access to Home Equity

Refinancing can unlock the equity youve built up in your home. This can provide the necessary capital for home improvements, cover the costs of higher education, or address other significant financial needs. This access to equity can act as a financial springboard, allowing you to pursue your aspirations with greater ease.

The Refinancing Process

A clear understanding of the refinancing process is paramount for a smooth and successful experience. Heres a step-by-step guide to navigating the process with Chase:

Step 1

Begin by meticulously reviewing your current loan terms. This includes the interest rate, the amount of your monthly payments, and the remaining balance on your mortgage. This initial assessment is crucial in determining whether refinancing is, in fact, a financially sound decision for your particular circumstances.

Step 2

Prepare all the necessary financial documents. This generally includes proof of income (such as pay stubs and W-2 forms), your tax returns, and bank statements. Having these documents readily available will streamline the application process and expedite the entire refinancing timeline.

Step 3

Submit your refinancing application through Chase's user-friendly online portal or by visiting a local Chase branch. A dedicated Chase representative will guide you through the application process and provide detailed information on available Chase mortgage rates for refinancing. They are there to answer your questions and offer personalized assistance.

Costs Associated with Refinancing

While refinancing can yield substantial long-term savings, its essential to be fully aware of the associated costs. Understanding these costs upfront will help you manage your finances effectively.

Closing Costs

Refinancing typically involves closing costs. These can range from approximately 2% to 5% of the total loan amount. These costs encompass various fees, including appraisal fees, title insurance premiums, and origination fees charged by the lender.

Prepayment Penalties

It is worth noting that some loan agreements might include prepayment penalties if you choose to pay off the loan early through refinancing. Carefully review your current loan agreement for any such clauses before proceeding with the refinancing application. If prepayment penalties exist, factor those costs into your overall savings calculation.

Current Market Trends in Mortgage Rates

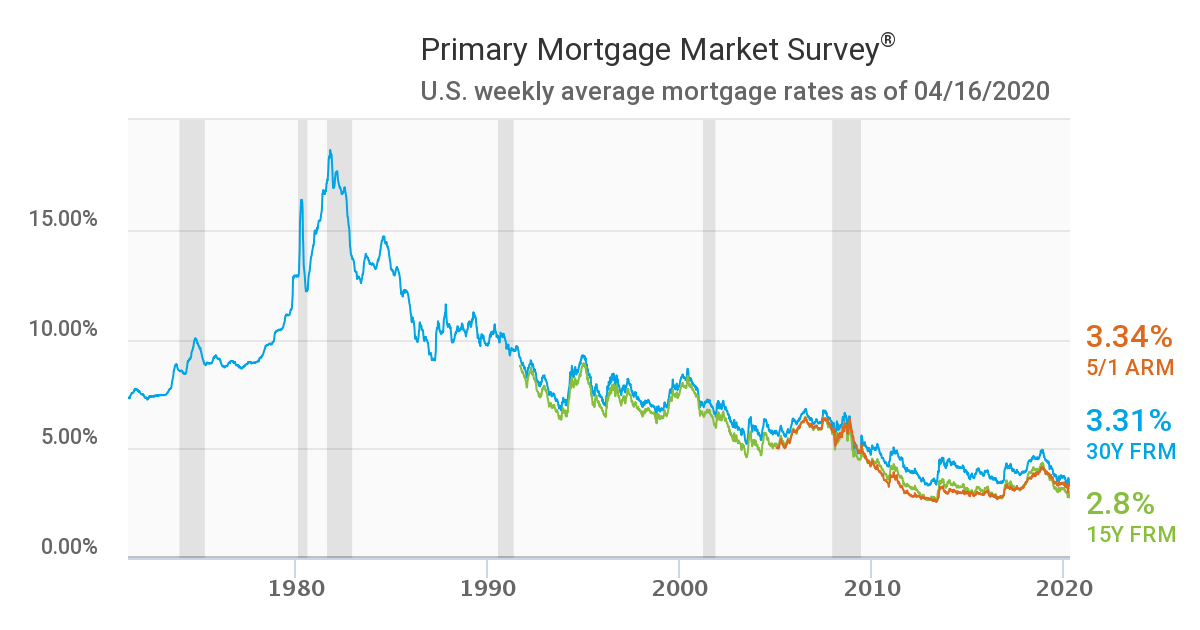

Staying abreast of current market trends is a critical step in making a well-informed decision about refinancing. The ability to time your refinancing application effectively is dependent on understanding the ebbs and flows of the market. As of the latest data, mortgage rates have generally been trending lower, making it an opportune time to consider refinancing. For example, according to the Federal Reserve Bank of St. Louis, the average 30-year fixed mortgage rate has been hovering around the 6% mark in recent months, though this is subject to change.

Impact of Economic Factors

A range of economic factors, including inflation and the policies of the Federal Reserve, can significantly influence prevailing mortgage rates. Keeping a vigilant eye on these macroeconomic indicators will empower you to make a well-timed and strategic refinancing decision. The economic landscape is constantly shifting, so staying informed is a must.

Comparison with Other Banks

When you are exploring Chase mortgage rates for refinancing, it's highly advisable to compare those rates with offers from other financial institutions. While Chase is generally recognized for its competitive rates and strong customer service, other lenders may offer promotions or special deals that are worth investigating.

Key Points to Compare

When comparing Chase with other banks and lending institutions, carefully consider the following factors:

- Interest rates offered by each lender

- Closing costs and any associated fees

- The quality of customer service and the level of support available throughout the refinancing process

Conducting thorough research and due diligence will ensure you select the refinancing option that best aligns with your specific needs and financial goals. Don't be afraid to shop around to get the best deal.

Tips for a Successful Refinancing Experience

To maximize the benefits of your refinancing journey, consider following these helpful tips:

Shop Around for the Best Rates

Don't settle for the first rate you're offered. Take the time to actively shop around and compare rates from multiple lenders. This should include Chase and a variety of other institutions to ensure you are securing the best possible deal available.

Improve Your Credit Score

A higher credit score will likely qualify you for lower interest rates. Take proactive steps to improve your score by paying down debt, making your payments on time, and diligently monitoring your credit report for any errors. Improving your creditworthiness prior to applying can save you a significant amount of money in the long run.

Understand All Fees and Terms

Carefully read the fine print of the refinancing agreement. Fully understand all associated fees and terms. This will help you avoid any unexpected costs or hidden surprises down the road. Transparency is key to a successful refinancing experience.

Frequently Asked Questions

What Are Chase Mortgage Rates for Refinancing?

Chase provides competitive mortgage rates for refinancing. These rates fluctuate based on several factors, including your credit score, the loan-to-value ratio (LTV) of the property, and the specific type of loan you're applying for. Interest rates are also influenced by overall market conditions, so they are always subject to change.

How Long Does the Refinancing Process Take?

The refinancing process typically takes between 30 to 60 days to complete. This duration is influenced by the complexity of your particular loan and the efficiency with which documents are processed. The more prepared you are, the faster the process will be.

Are There Any Prepayment Penalties with Chase?

Chase generally does not impose prepayment penalties on most of its mortgage products, allowing you to refinance without incurring additional fees. However, always confirm the specific terms of your loan with your Chase representative.

- Discover Chic Colleen Your Guide To The Social Media Star

- Eric Churchs Rise From Capitol Signing To Country Icon Unveiled